Tax on sale of rental property calculator

You Report Revenue We Do The Rest. Next time when you are trying to estimate the amount of taxes you would owe when.

Calculating Returns For A Rental Property Xelplus Leila Gharani

For commercial buildings the term.

. Once you know what your gain on the property is you can calculate if you need to report and pay Capital Gains Tax. Ad Easily File Your Rental Property Taxes. Depreciation is taxed at 25 and capital gains are taxed.

You can claim 1000 as a tax-free property allowance. Rental income tax breakdown. Selling Price of Rental Property Adjusted Cost Basis Capital Gains x Tax Rate Depreciation x 25 Tax Rate.

Capital Gains x Tax Rate Depreciation x 25 Tax Rate. 400000 - 300000 100000. Your total gain is simply your sale price less your adjusted tax basis.

Sold land sold business premises sold. Rental income is taxed as ordinary income. Your rental earnings are 18000.

To calculate your depreciation divide your property value by 275 and you get the amount of depreciation youre allowed to claim each year. 2022 Capital Gains Tax Calculator Use this tool to estimate capital gains taxes you may owe after selling an investment property. This handy calculator helps you avoid tedious number.

This means that if the marginal tax bracket youre in is 22 and your rental income is 5000 youll end up paying 1100. This capital gains tax calculator estimates your real estate capital gains tax plus analyzes a 1031 like-kind exchange versus a taxable sale for benefit financial mentor. You cannot use the calculator if you.

This means that if an investor is in a 22 marginal tax bracket and their rental income is 5000 the investor would end up paying 1100. APIs Capital Gain Tax Calculator to calculate taxable gain and avoid paying taxes by taking advantage of IRC Section 1031. The tax rate can vary from 0 to.

As a result your taxable rental income will be. Take 100000 x ½ 50 taxable x 50 rough tax rate on passive income 25000. The tax rate can vary from 0 to 396 depending on.

Capital gain in this scenario. Rental income is taxed as ordinary income. Selling Price of Rental Property - Adjusted Cost Basis.

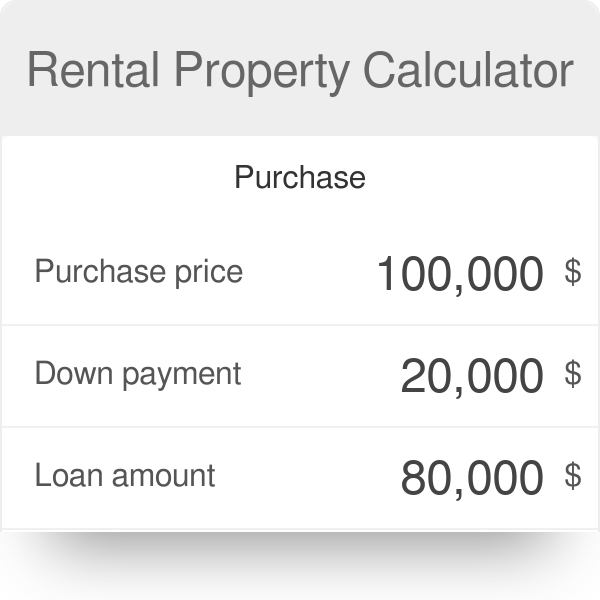

Rental Property Calculator How To Calculate Roi

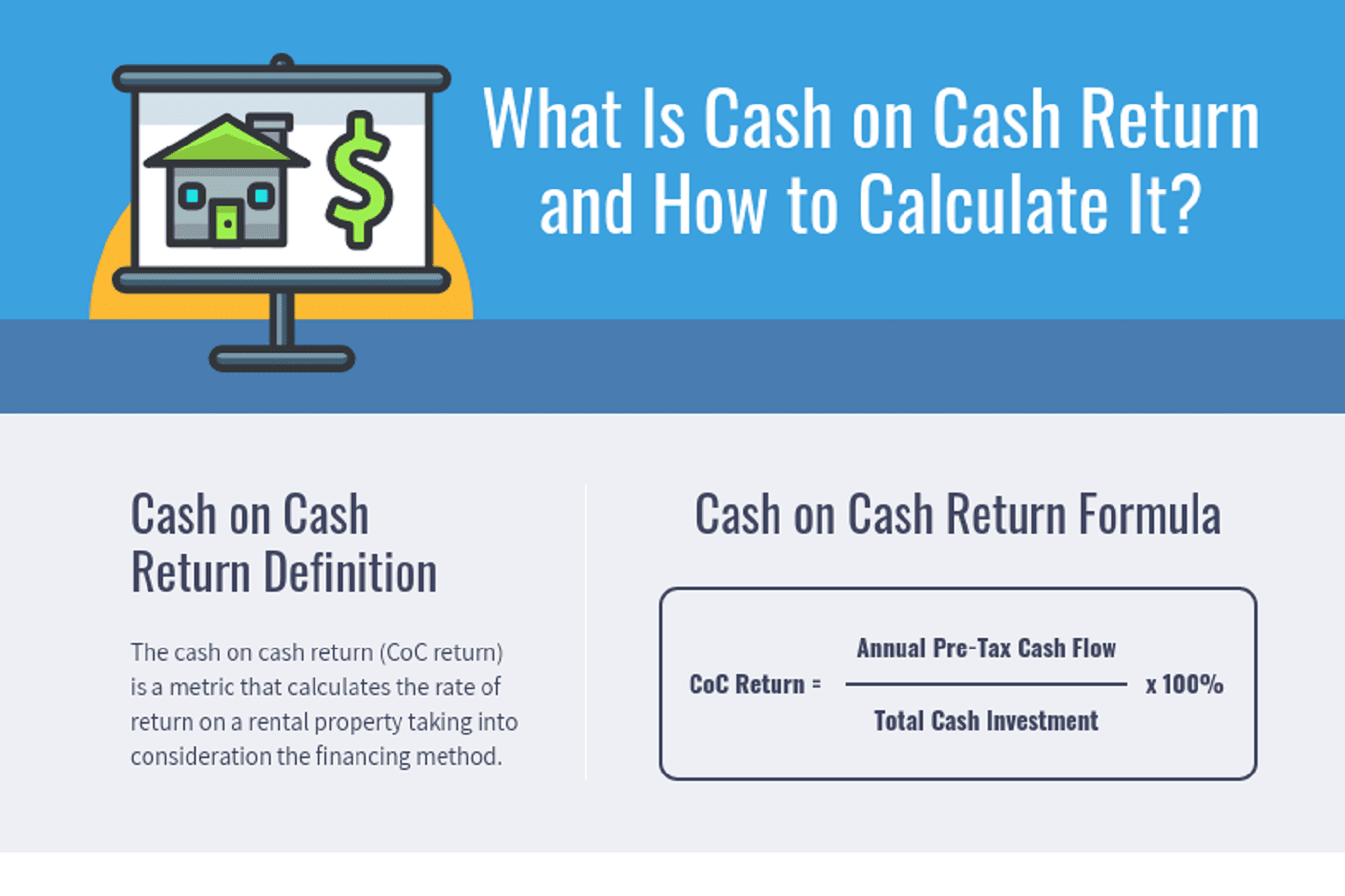

What Is Cash On Cash Return Infographic Mashvisor

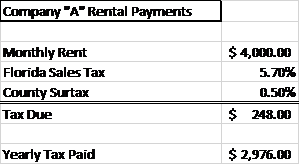

How To Calculate Fl Sales Tax On Rent

Investing Rental Property Calculator Mls Mortgage Real Estate Investing Rental Property Rental Property Management Real Estate Rentals

Calculating Returns For A Rental Property Xelplus Leila Gharani

Tax Calculator For Rental Property Cheap Sale 57 Off Www Ingeniovirtual Com

Pin On Airbnb

Rental Property Calculator Most Accurate Forecast

Rental Property Calculator Most Accurate Forecast

Rental Property Calculator Forecast Your Rental Property Roi

How To Calculate Rental Income The Right Way Smartmove

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Calculating Returns For A Rental Property Xelplus Leila Gharani

Calculating Returns For A Rental Property Xelplus Leila Gharani

Pin On Airbnb

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Rental Property Calculator Most Accurate Forecast